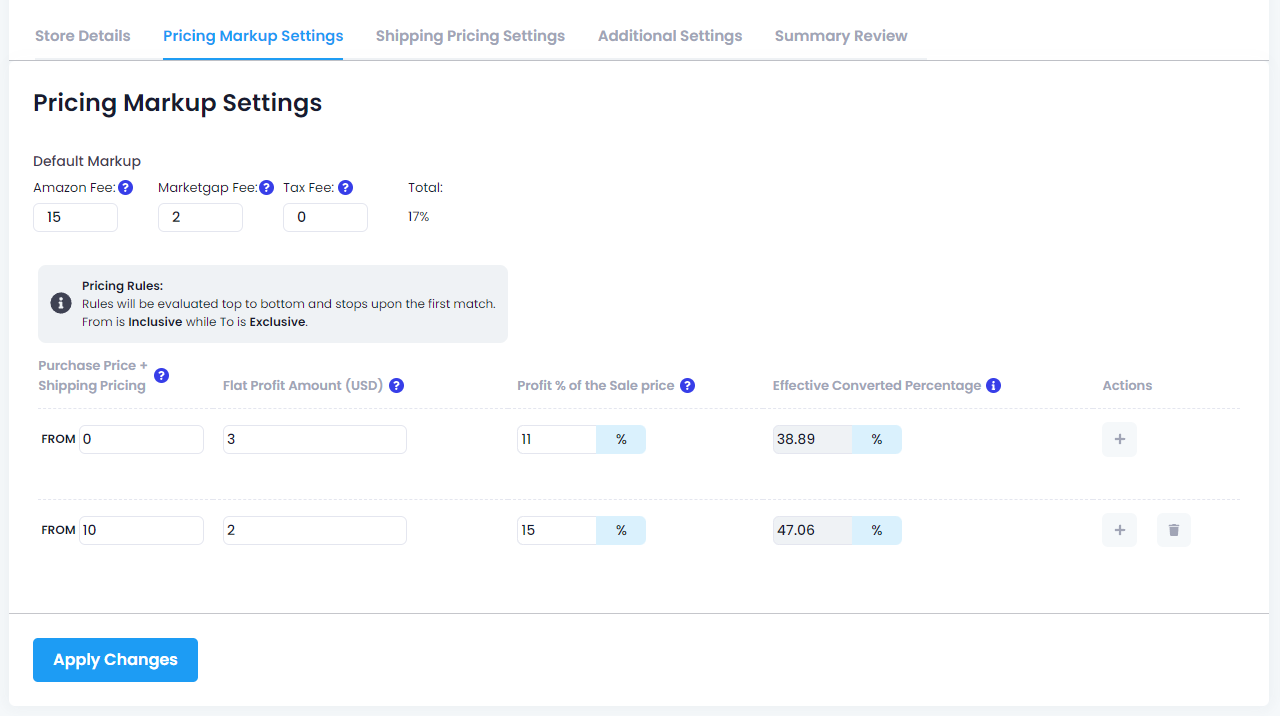

Pricing Markup Settings

Welcome to the Pricing Configuration Help Page. Here, we'll explain the key elements of configuring pricing settings in a simple and clear manner.

Amazon Fee:

Amazon fee is also referred to as the Amazon Referral Fee, which is about 10-17%, depending on the marketplace and the category of items you sell.

MarketGap Fee:

MarketGap sales fee, which is 2% by default.

Tax Fee:

Tax fees in MarketGap represent the taxes included in the list price of products, applicable mainly in EU Marketplaces and Amazon.com.au. Remember, these fees are based on the list price, not the sale price before taxes. This is key for correctly pricing your products in markets where VAT or equivalent taxes are included in the list price.

EU, AU, and Similar Marketplaces: Tax is included in the list price. For example, a product listed for $100 on Amazon.com might be listed for $120 on Amazon.co.uk, assuming a 20% VAT.

CA and Other Marketplaces: If a sales tax is added to the list price, it's not included in MarketGap's tax fee, as Amazon automatically adds it.

When setting prices on MarketGap, use the formula below to convert your VAT rate for accurate listing

100 - (100 / (VAT + 1))

*Add 20% as 0.20 in VAT.

Example:

100 - (100 / (0.2 + 1)) = 16.66667%

For sellers who are tax-exempt or responsible for their own taxes/duties where Amazon doesn't collect them, these fees can be added manually in MarketGap.

For a more in-depth understanding, including how to calculate these taxes and nuances across different marketplaces, please refer to our detailed article on tax fees in MarketGap.

Bracket Range Rules:

1. Markup is applied to items within defined price ranges on the "From" amount you set. The next row's "From" becomes the previous row's “To”.

2. Rules are assessed sequentially, stopping at the first match.

3. The "From" value is inclusive, encompassing items equal to or greater in cost.

4. The last line represents items equal to or higher in cost without an upper limit.

Example: To select a bracket from 0-10 USD, add a new line of your next bracket from "10"; this will set the first line as 0$-10$.

Purchase Price + Shipping Price:

The "Purchase Price" refers to the original cost of an item on the purchasing marketplace.

The "Shipping Price" refers to the shipping pricing you have set up in the shipping pricing setting, Marketgap will calculate the shipping price according to your settings based on the item weight.

Based on the combined pricing of the Purchase Price and Shipping Price of an item, you can customize a Pricing Markup you would like.

Flat Profit Amount (USD):

You can add a flat USD amount; MarketGap will add the Markup percentage on top of this amount, so you will end up with the Flat Amount after Amazon, MarketGap, and Tax fees are deducted.

Profit % of the Sale price:

Add a Profit Percentage of the Sale Price

if you add a percentage of 10% and you have a sale of 100$, the profit percentage will be 10$.

Recommended: 5% - 20%

Lower may be too low to cover operational cost

An higher percentage may lead to High Pricing error on Amazon and Fewer sales.

Effective Converted Percentage:

The Effective Percentage, used by MarketGap to determine the Listing price, is calculated as follows:

Effective Converted Percentage = (100 / ( 100 - Amazon Fee % + MarketGap Fee % + Tax Fee % + Profit %) - 1))

How MarketGap calculates the Listing Price:

(Item cost + Shipping cost + Flat Profit) + ((Item cost + Shipping cost + Flat Profit) * (100 / ( 100 - Amazon Fee % + MarketGap Fee % + Tax Fee % + Profit %) - 1))

= (Item cost + Shipping cost + Flat Profit) + ((Item cost + Shipping cost + Flat Profit) * Effective Converted Percentage

Example:

Item cost on Amazon.com: 20 USD

Item Weight: 1 LB (16 ounces)

Shipping Price: 10 USD

Flat Profit Amount: 5 USD

Amazon Fee: 15%

MarketGap Fee: 2%

Tax Fee: 10%

Profit Percentage: 10%

Calculation:

= (Item cost + Shipping cost + Flat Profit) + ((Item cost + Shipping cost + Flat Profit) * Effective Converted Percentage

= (20 + 10 + 5) + ((20 + 10 + 5) * Effective Converted Percentage)

= (35 + (35 * Effective Converted Percentage)

= 35 + (35 * 58.73%)

= 55.56 USD

Note: 55.56 is before currency conversion to the target currency.

We're committed to ensuring your understanding of pricing configuration. Should you need further clarification or assistance, our dedicated customer support team is here to guide you. Your success with MarketGap is our priority, and we're here to support you every step of the way.